What can I do if Inflation is Here to Stay?

Last Friday, the US Consumer Price Index (CPI) data for May showed that overall inflation rose by 8.6%. This is higher than the 8.5% recorded in March, and 8.3% recorded in April. Core inflation rate, on the other hand, decline slightly to 6.0% from 6.2% in April. This is not great news as both numbers were above analysts estimates, and this, sadly, probably shows that inflation has not yet peaked. Main problem lies with energy prices, as price of crude oil soar past USD 120.00. Energy and commodities prices do not seem to be peaking anytime soon, with Russia-Ukraine war on-going. Higher inflation number also does not bode well for the market, as seen from last Friday's market movements, with DJIA down 2.73%, S&P 500 down 2.91% and NASDAQ down 3.52% in one day.

Besides being affected by market movements, which is beyond my control, I believe many of us will also feel the heat from inflation impacting our daily lives. Prices of consumer goods and food have increased by leaps and bounds, negatively impacting our wallets. Market movements are beyond our control, but the way we choose to live our lives in times of high inflation is definitely within our control. So what can I do to reduce my expenses, without needing to feed myself with just instant noodles daily?

1) Save more cash to buff up emergency cash.

Cash is definitely more important than before. I disagree with the saying that "Cash is Trash" during times of high inflation. During such times of high inflation and market crashes, cash and cash-flow enables us to cope with uncertainties (such as unforeseeable events like job losses due to looming recession) and rising prices of commodities and consumables. In addition, it is also the most important “bullet” required to “buy the dip”. Hence, definitely more pros than cons to keep some cash on hand. For me, cash comes from 2 sources, active income from work and dividends from my Dividend Portfolio. Shall continue to work hard to generate active income. Dividends will be lumpy as most of companies and REITs in my portfolio declare dividends on a half-yearly basis, hence got to save up more.

2) Eat in rather than eat out.

Prepare your own meals may help to lower costs. Due to inflation, I have seen an increment of about 20% in the prices of many food items in hawker centers, food courts and coffee shops. The prices of 3 pieces of 'chwee kuey' at my area has already rose from SGD 1.50 to SGD 1.80, and the prices of 'yong tau foo' has rose from SGD 0.50 to SGD 0.60 per piece. Part of the rising cost can be defrayed by buying groceries and cook your own meals at home (despite rising prices of groceries as well). All I can say is, the Singapore government has done relatively well to provide cheaper alternatives for the everyone, compared to the situation in Johor, Malaysia, where my mum is complaining about rising prices on a weekly basis (Yup, prices of frozen minced pork is changing on a weekly basis, from RM 12.00/kg to RM 17.00/kg in 4 weeks). Personally, dining at home will lower my cost by approximately 5-20% per day.

3) Buy house brands instead.

To complement the above, buying house brands will also help to mitigate costs. Coffee is a staple for me. I need a minimal of 1 cup of coffee each day. To me, quantity outweighs quality. Thus, instead of the luxurious Starbucks which I do not yearn for, I just get the cheapest 'Fairprice brand' instant coffee, which is about 20-30% cheaper than Nescafe instant coffee, and definitely 99% cheaper than Starbucks coffee. I believe house brands are sufficiently good for me, but at a fraction of the cost! Hence, why not.

4) Buy Consumables in Malaysia

With the SGD/MYR exchange rate hovering near all time high, it makes sense to make a trip to Johor Bahru to get some consumables at a fraction of the cost due to the favourable SGD 1 : MYR 3.17 exchange rate. With the causeway completely opened to pre-Covid times, a trip to Johor could be a short get-away, and items like instant noodles, canned food, detergents, toiletries and other non-perishables are definitely great buys at this time to help with controlling expenses. I believe the best deals for drivers could be the petrol price. Every savings count! This year, I have yet to go back to Johor on a weekly basis (which is what I do weekly pre-Covid to visit my parents). In time to come, when I can plan my work so I can go back weekly, I will be able to buy more items there. However, do note that there is a upper limit to the total value of items that can be brought into Singapore from Johor tax-free. If you have spent only less than 48 hours outside Singapore, the value of goods tax-free is only SGD 100.00, while above 48 hours outside Singapore, the value of goods tax-free is SGD 500.00. Do note that specific items like eggs are not allowed!

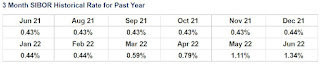

5) Refinance/ Reprice Mortgage Loan to Fixed Rate

I am glad that I am in time to apply for refinancing soonest possible in late March 2022 to lock in the mortgage interest rates. Initially I wanted to wait till September 2022 to do repricing (my current lock in period ends in October 2022), as I can have a free conversion with the same bank. However, with the high inflation and seeing how 3-month SIBOR is climbing like no tomorrow, I decided to go with refinancing instead in late March 2022 (for refinancing, application can be done 6 months before lock in period ends). Good news for myself is that my application managed to get approved with 2 year fixed rate at 1.45% for 1st year and 1.55% for 2nd year. This is definitely much higher than a few months back, but its the best rate I can get for now. Seeing the 3-month SIBOR rates for June 2022 at 1.34%, I believe I have made the right decision, for at least the near term.

Knowing that I have locked in fixed rate for the outstanding loan, and more predictability with the monthly instalments definitely gave me peace of mind for the next 2 years to ride out the economic doldrums (especially when FED raised interest rates by 0.75% in June 2022!).

Do you have other tips and tricks to maximize the value of every dollar? Do share with me, so I can learn more as well! For now, hope everyone is living well. I will tighten my belt for now to tide through the looming recession/ slowing of economy, and emerge stronger financially! Barista FIRE, here I come...!

Comments

Post a Comment