Portfolio Update for April 2023

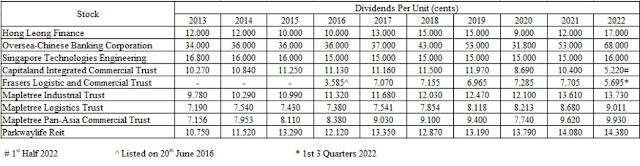

This will be a relatively short post, just to update on the transactions for the month. For the month of April, volatility has once returned. The March CPI data released in the first half of the month showed that inflation is cooling down, and that drove optimism in the markets. Investors are pricing in that the FED will pivot and start cutting rates in 2023, despite FED's repetitive iteration that there will be no rate cuts in 2023. However, in the second half of the month, jitters returned to the market almost immediately as investors are worried for the 1 st quarter earning results. Analysts have commented that this quarter's earnings may be the worst earnings by the companies since 2020. This period is always the period that I look forward to, as well as remain slightly jittery. I am looking forward to it because it signals that dividends are coming in from my local Dividend Portfolio soon, while I remain jittery because it will cause the share price of my shares in