How S-REITs will Perform Through This Period of Rising Interest Rates

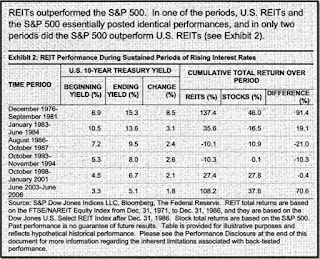

Since the US Federal Reserve announced their plans to raise interest rates and start quantitative tightening at the start of 2022, the price of most S-REITs has been declining. It is known that generally, REITs are sensitive to interest rates as all REITs are leveraged to various extents. On the surface, it will seem that rise in interest rates will have a negative impact to REITs, as it will increase their cost of borrowings. However, many REITs have already done their hedging by locking in their borrowing cost. In addition, many studies and research reports have shown that through history, price of REITs do increase during times of rising interest rates. Seeking Alpha has a write-up on how rising interest rates has historically been good for REITs, and The Fifth Person also has a YouTube video discussing how interest rates affect REITs.

According to The Fifth Person (discussion more directly applicable to S-REITs), they mentioned that the reason for the rise in price of S-REITs on the backdrop of rising interest rates are due to:

1) Increase interest rates indicate improving economic environment, thus businesses are doing better hence offices, retails and warehouses can raise rentals.

2) More willingness to travel boost hospitality REITs.

3) Not all REITs are equal, only quality REITs will perform better as they have pricing power to command higher rents.

4) REITs with well-staggered debt maturity profile will lower the risk in such times.

However, in the short term, based on some of the S-REITs that I closely monitor above, most of their price has decline by approximately 3-17%, while others has increased from 0.5 to a whopping 40%! The out-performers are generally hospitality and retail S-REITs, while logistics and industrial S-REITs are the obvious laggards. This is definitely due to the improving outlook for COVID, as countries open up and “revenge travel and spending” predominates after all the lock-down and travel restrictions in the past 2 years. On the other hand, beneficiaries of the pandemic times like logistics and industrial S-REITs are seeing their prices declining to March 2020 levels. My Dividend Portfolio comprises of more than 65% S-REITs, thus the recent decline has negatively impacted the value of the portfolio in the short term.

Will the longer term prices of S-REITs follow historical trends, rising to higher levels during this period of rising interest rates? Or will this time be different?

Personally I think this time would probably be similar to the past.

1) Rising interest rate is going to have a negative impact to REITs in the short term. This is especially so when the number of basis points increase in interest rates post-July is currently uncertain. With such uncertainty still lingering around, and inflation has not convincingly abated, I believe pressure on REITs' prices still persist.

2) In the long term, recovery may be lumpy. Retail and hospitality S-REITs may continue to outperform industrial and logistics S-REITs during this period due to revenge spending. However, if a technical recession do happen in Singapore and persist for longer periods of time, this may affect all REITs adversely as well.

3) As discussed by The Fifth Person in the video, not all REITs are equal. Strong sponsors remain an important aspect when picking S-REITs to invest. Despite the recent turmoil in Mapletree REITs, I believe in the long term they can still continue to grow and perform. Despite the positive performance by retail S-REITs (Capitaland Integrated Commercial Trust has shown it's resiliency), Mapletree Commercial Trust (MCT) is going the other way due to its upcoming merger with Mapletree North Asia Commercial Trust (MNACT). By August, MCT will cease to be a pure Singapore play, and renamed to Mapletree Pan-Asia Commercial Trust (MPACT). I believe investors who do not like the merger may reduce their holding during this period. Hopefully with this matter set in stone, the future will be brighter for MCT/MPACT.

All in all, I think S-REITs will have a roller-coaster ride in the near term. Since the price volatility is beyond my control, all I can do is to sit tight, continue to hold on to quality S-REITs, and just ride through the volatility. Sincerely hoping inflation can ease soon, as it has definitely affected the lives of the average persons as prices of consumables and necessities are rising through the roof. This definitely makes me rethink my personal Barista FIRE number. But I guess, there's no point fretting over things I cannot control. I shall just continue to slowly grow my portfolio, and reinvest dividends. Barista FIRE, here I come...!

I also believe that reits will survive rising interest rates environment.

ReplyDelete1.This is not the first time in recent years that interest rate is on the rise. It started rising around 2016 after the 2008 GFC. Some reits were peaking around 2019 to only suffer price collapse due to Covid. Thats when interest rate got cut again.

2. I am also in the opinion that rising interest rate in normal circumstance is actually a good sign to come as it means economic activity is picking up, thus less intervention from government is required. However, this time around, the main intention is to fight the escalating inflation but some parts of the economy is still trying to recover from covid impact. So with run away inflation in the equation, not too sure how things will turn out.

3. I will do what you mentioned as well, to hold on to my positions and to buy only quality reits preferably with fixed rate loans and low gearing, and also to diversify into growth stocks that were impacted by covid.

Wow, didn't expect to get comments from one of my favourite bloggers! Thanks Happy REIT Investor for the insight! Yup, definitely just hold on and stay put, since the macro environment is beyond us. Just chill and collect dividends from quality REITs.

DeleteYou are too kind! I'm blushing behind the monitor already!

DeleteHaha, don't be. Looking forward to more of your blog post and continue to learn from you!

Delete