Why do I Contribute to All 3 CPF Accounts as a Self-Employed?

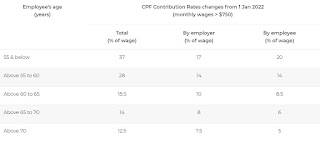

Central Provident Fund (CPF) is a compulsory comprehensive savings and pension plan for working Singaporeans and Permanent Residents primarily to fund their retirement, healthcare and housing needs in Singapore. Accordingly to law, CPF contribution rates by employers and employees are shown in the table below from 2022.

The contributions will be distributed into three accounts, namely Ordinary Account (OA), Special Account (SA) and Medisave Account (MA). As shown below, the allocation rates differs with age, with increasing allocation towards MA for medical purposes.

For the self employed, it is not mandatory to contribute to all three accounts. Instead, it is only compulsory for self employed persons to contribute to MA. The contribution amount is based on the Net Trade Income, as well as the age group of the self employed person, details shown below.

Based on the latest news in November 2022, workers in the gig economy (current discussions involve food delivery workers and private-hire car drivers providing ride-hailing services) will be required to contribute to CPF, provided that they are below the age of 30 during the first year of the implementation of the ruling. The exact date of implementation has yet to be confirmed, but the illustration given is if the ruling is to be implemented on January 2025, then any worker in the gig economy born in 1995 or later must have CPF contribution, regardless of their age when they began work for the various platform.

Although I do not work for any of these platforms, but private tutoring belongs to the gig economy/ freelance category as well. Personally I welcome this move, as I have been contributing since I started this self employment journey way back in 2015. So, why do I religiously put 37% of my monthly income into CPF (all 3 accounts), instead of just contributing the mandatory 8% into MA?

1) I like CPF and use it as a Risk-Free Bond

There are two main groups of people, those who believe in CPF (think 1M65), and those who do not. Personally, I like how CPF works, and I am treating CPF as the bond allocation, as the OA is compounding on 2.5%, while SA and MA are compounding on 4% annually risk free! As my income is not high, it will be hard for me to reach Full Retirement Sum (FRS). Therefore, I only have moderate amount in my CPF (approximately 21% of my net liquidity), which is a comfortable “bond allocation” I would like to have in my overall portfolio. As such, I keep all my CPF monies strictly in CPF, and I do not use any amount to invest via Central Provident Fund Investment Scheme (CPFIS), which risks exposing my CPF monies to the volatilities of the markets. I am already exposing my savings and cash component to the fluctuations of the market, hence for my CPF monies, I would like it to remain as the stable component (and ALMOST risk-free), yet compounding at around 4% yearly for my retirement.

2) I can Save on Taxes

Contributing to CPF makes me eligible for tax relief. The amount of CPF relief is capped at SGD 6K for ordinary wage contributions. My income is not high, so the amount of CPF relief is definitely much lower than SGD 6K. But every dollars and cents count! This way I can pay lesser tax, and pay slightly more towards my retirement piggy bank.

3) I Need a Safety Net for Medical

As I have pre-existing conditions, I am unable to purchase more term insurance or rider to strengthen the medical safety net. This is where I am appreciative to MA, and implementation of Careshield. When in need after retirement, I can use my MA monies to pay for medical bills (partially funded), and in the event I am hit with disabilities, Careshield may help, no matter how minimal it is. So probably what is important now is I go for regular checkups to prevent any further deterioration of my conditions and stay relatively healthy.

4) I like to have a Stable Income from CPF Life after 65 Years Old

Although I know that I won't be able to meet FRS by the time I am 65, the contribution and accumulation now will still end up with a considerable amount by then. Barring any unforeseen circumstances, I will be able to receive a stable amount of between SGD 500 to SGD 1000 starting from 65 years old. That would translate to MYR 1.60K to MYR 3.20K, based on current exchange rate. With effects of inflation, this amount may not be significant about 25 years later, but it's definitely better than nothing. It will still be a good amount to complement my portfolio for withdrawal during retirement, till the day I passed on.

5) I am Concerned of my Singapore Permanent Residence (SPR) Status

I know according to law, I only need to contribute 8% of annual net income into MA. However, I am concerned about any possibility of my SPR status being revoked. As such, I would very much prefer to comply above requirements, to file and pay my taxes to IRAS on time, and of course, to contribute to my 3 CPF accounts monthly diligently (But I believe I am just paranoid, so please do not pay attention to this point).

6) I have the Flexibility to Withdraw my Entire CPF when I Want

This option will not work for Singaporeans. I hope I do not need to reach this stage, because if it ever happens, it probably means I am in some form of financial doldrums. But basically, the CPF can act as my ultimate final safety net, and before I declare any form of bankruptcy. I can apply to renounce my SPR status, never to return to Singapore for work. Two years later, I can withdraw my CPF monies and remain in Malaysia. This path is definitely one that I hope will never happen.

All in all, I am actually grateful with the enforcement of CPF, which indeed helps me in my retirement planning by squirreling away a portion of my income to SA where I cannot touch. I have thought of putting the 29% cash (37% Contribution - 8% Mandatory MA Contribution) into the Employees Provident Fund (EPF, the Malaysia equivalent of CPF) instead, which gives higher interest rate of approximately 6% annually compared to 4% in SA. However, if you have seen my previous post, you will understand that the additional 2% may not be sufficient to offset the depreciation of the Malaysia Ringgit against the Singapore Dollar. Therefore, I believe CPF is beneficial to myself, especially in my retirement years! Barista FIRE, here I come...!

Comments

Post a Comment