How My Portfolio Changed from 2022 to 2023

Looking back at 2022, it has been a tumultuous year, full of crashes with puny bright spots. Overall my portfolio has been in a downtrend because of the widespread negative sentiments. With the gloomy macroeconomic environment, there were also some changes within my portfolio due to some exit strategies and some rebalancing due to 'buy the dip' actions.

This post serves as a reflection for myself for the year, and hopefully, allow myself to learn from my investing journey in future.

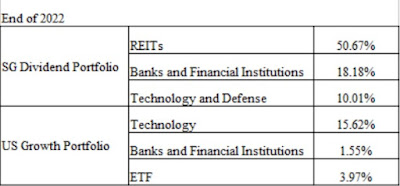

As a summary:

As mentioned in all my previous portfolio posts, I only started venturing into the US market in December 2021. Therefore, at the end of 2021, the US Growth Portfolio allocation only took up less than 7% of the entire portfolio. With consistent dollar cost averaging (DCA) into the US market throughout the year, as the market keep crashing, it has pushed my US Growth Portfolio allocation to slightly more than 21%. This inevitably means my SG Dividend Portfolio allocation decreased to less than 79%, but there's growth in both portfolio in absolute terms.

Delving deeper, for the SG Dividend Portfolio, the REITs allocation has declined, while the allocation to both Banks and Financial Institutions and Technology and Defense remain approximately the same. This is in line with the rules that I set for myself in last quarter of 2022, which is to DCA only when the REITs reached a yield of 6.5% or above, and when the non-REITs reached a yield of 5% or above, due to the increase in risk-free interest rates. Therefore, I DCA more consistently into the financial institutions and lesser into the REITs, thus the allocations changed as shown above (but the absolute capital injected into all sector increased).

On the other hand, for the US Growth Portfolio, there is a huge jump in the allocation from a mere 6.83% allocation to 21.08%. This is mainly due to the decision to build up my growth portfolio at the first half of the year, to invest in big Tech companies like Apple, Microsoft, Tesla and Google. For diversification, I also started to invest in JP Morgan, which remains to be the sole green in my Growth Portfolio (but only a mere 1.55%).

One important variation is the decline in allocation to Exchange Traded Fund (ETF) from about 6% to below 4%. This is because in mid 2020 and mid 2021, I took my first steps to be exposed to US equities via Robo-advisors, Syfe and Endowus respectively through DCA. However, after I got more confident with dabbling in the US markets on my own through Interactive Brokers, I decided to liquidate my entire portfolio with both Syfe and Endowus, and DCA directly into VOO and META ETF (both are still in the red) on my own.

Yup, that's it. That is how my portfolio allocation has changed from the end of 2021, to the end of 2022. Once again, looking forward to 2023, DCA will continue to be my main strategy. US Growth portfolio will continue to grow slowly due to the lack of capital (cash remains low), and for the SG Dividend Portfolio, dividend reinvestment will continue to grow my total number of shares to hopefully increase my total dividends to be collected in 2023 to a target of SGD 20K. If opportunity arises and if my warchest permits, capital injection to the Dividend Portfolio will also occur. May I be able to tide through 2023, to a better 2024! Barista FIRE, here I come...!

Comments

Post a Comment