Why do I Plan to Retire in Malaysia

Just last month, there was the big hoo-ha regarding the topic of retirement. It started with the podcast where Channel News Asia (CNA) interviewed a Singaporean YouTuber, and it ended with the following:

Many people had issues with retiring at 35. Others had issues with the USD 1M portfolio. For me, I have no issues with the podcast, because that is not for me, nor that is what I had. All I can think of, for myself, is what can I achieve, when can I semi-retire/ retire, where should I retire and how can I live my life as a retiree.

Based on my current financial position, I believe I will be semi-retiring in Singapore, and commence full retirement in Malaysia. YouTuber “Kelvin Learns Investing”, being a Malaysian, also shared his views why he is not considering to retire in Malaysia. I do understand his perspectives, and I respect his choice (I just think that he amplified the cons, which is actually common everywhere else). However, as mentioned, those are his perspectives, and I just happen to hold other views. Below are the few reasons why I believe Malaysia is the place to be for myself.

1) Finances and Affordability

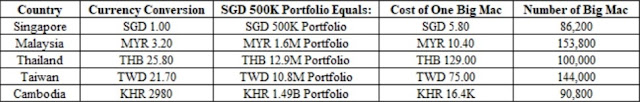

As I am not a high income earner, and my savings are limited, I am not able to save huge a large portion of my income. Based on what I have achieved thus far, I need to retire in a country where my portfolio can be multiplied based on exchange rate (this is actually not important, just a numbers game, the main objective of this point is mainly to compare affordability). This is the first step to help me shortlist a few countries (and ones that I have been to), namely Malaysia (using MYR), Thailand (using THB), Cambodia (using KHR and USD interchangeably), and probably Taiwan region...so sensitive currently...country/region... eeks (using TWD). Vietnam and Indonesia is not included as I have not been to these 2 countries. I may review this retirement plan again after I visit Indonesia and/or Vietnam in the near future. As of August, the exchange rate for the respective currencies, and my simplified version of the "Big Mac Index" are approximated as follows:

I wish to highlight that this is definitely not an accurate measure of affordability. It is more like an estimate. This is because Big Mac, being a fast-food from the West, may be much more expensive than local food items. This caused the accuracy to be deviated. Nonetheless, using the number of Big Mac the portfolio can buy, this simplified comparison of affordability above (comparing with the same baseline) shows that Malaysia is the most affordable country out of the 5.

2) Familiarity of the Language and Culture

Growing up in a Chinese-speaking family in Malaysia, I am actually weak in other languages (and definitely bad at learning new languages). Thai and Khmer are both beautiful languages, but it's way too hard for me to deal with. That is a small hurdle for me, small because the locals are able to converse in simple English and some even Mandarin, due to the booming tourism sector in their country. Malay, on the other hand, is also troubling for me. Yes, being a Malaysian but not knowing how to speak Malay (as I was educated in Singapore since young, and I am not learning the language on my own), I had my fair share of issues. Thankfully, there are many accommodating Malaysians who will try to converse with me in English. Thus in terms of language, Malaysia and Taiwan are good options. Culturally, I am comfortable with both regions as well.

3) Food

Being a foodie, food is definitely an important aspect for me. Thai food or even Cambodian food are nice, but after eating for some time, I will still miss the simple Malaysian curry chee cheong fun, bak ku teh, and even laksa, just to name a few, which are the simple comfort food for me. So in terms of sustainability, Malaysian food is definitely one that will not go out of favour for me. Any cravings for Thai, Taiwanese and Cambodian cuisine can be satisfied during simple short travel trips!

4) Pace of Life

Living in Singapore for almost three quarters of my life made me accustomed to the fast pace of life here. Everywhere, we talked about efficiency, and things need to be done as soon as possible. On the flip side, if one has tried to live in Malaysia, it is true that the pace there is much slower in comparison. Truth to be told, I will not choose to work in Malaysia because of the slow pace there, which will amplify all inefficiencies when it comes to getting things done. However, retirement is a different story altogether. Semi-retirement or full retirement is exactly the time where one has to slow down the pace of life, and enjoy things around you. Rushing from point A to point B, or rushing to get things done is definitely not something I look forward to during retirement.

5) Housing

Having a roof over the head is an important aspect in retirement. Renting a place during retirement years create uncertainties in the later years. It is known that in certain areas, homeowners do not like to rent their property to the aged, simply because they are afraid the aged may (touchwood) unknowingly passed away within the property. It may be a taboo subject, but definitely factual. To prevent any of such predicament which will render one homeless, it's better to own one property for retirement for own stay. This is also the main reason why Malaysia is the place for me as I had bought a unit, currently rented out, but will be my retirement home when the time comes!

6) Medical and Hospitalization

Being a Malaysian, I am entitled to affordable healthcare in Malaysia. In government hospitals and clinics, some consultations can be as affordable as just MYR 1.00. Only the medications are charged, but also at a subsidized cost. The cons of government hospitals will be the long waiting times, which is similar everywhere, even in Singapore (but waiting times could be longer in Malaysia...remember, chill pace!). If one prefers to receive expedited treatment, one can definitely opt for private hospitals, where charges will be much higher. Give and take, pros and cons for sure.

7) Shielded from Natural Disasters

One of the most important aspect of being a Malaysian living in Malaysia and Singapore is that thankfully Malaysia is well shielded from natural disasters. Malaysia has only suffered from flooding due to heavy rains, but never to the extend of flooding in Cambodia due to the overflow of the Mekong River. Malaysia is also safe from typhoons and earthquakes, which are rather common in Taiwan. This makes Malaysia a safe haven for retirement. Being inexperienced, I do not foresee myself having the ability to keep myself safe during times of natural disasters.

8) Family and Friends

Most important of all, is I would love to retire in a place near to my family and friends. Most of my family and relatives are in Malaysia and Singapore, while most of my friends are in Singapore. Being an introvert, it gets very difficult for me to make new friends as I age. Hence old friends are important, besides family, to keep me sane and interactive.

Yup, that's it folks. Above are the 8 main reasons why I have chosen Malaysia as my retirement destination. Do note that all points stated above are based on personal preference and personal experiences. Definitely this may not cater/work for everyone. Just plan for yourself, as life is not just work and more work! That's all for now, Barista FIRE, here I come...!

Very comprehensive insights! Have not thought about the sensitivity of renting as a senior until I read your article.

ReplyDeleteThank you! It is something that is very real in Taiwan, maybe a little less so in other areas.

DeleteInteresting to compare affordability against number of big macs. An easy way to understand. Agree that life is not just work!

ReplyDeleteYup, there's definitely more to life than just work! Big Mac Index do exist! Can read up on it as a measure of affordability in every country. But take it as a gauge, because how affordable it is will also depend on individual's way of life.

Delete