Portfolio Update Q3 2022

This month marks the end of the 3rd quarter of 2022. Thus it's definitely a good time for me to record the performance of my portfolio to track how it has been.

To recap, I started my SG Dividends Portfolio in late 2017, and I began tracking the dividends and all reinvestment done starting 2018. To date, my SG Dividends Portfolio consist of banks, REITs and defense technology. On the other hand, I only started the US Growth Portfolio in late December 2021. Currently, my US Growth Portfolio consist of mainly big tech names, bank and exchange traded funds (ETFs).

Being a relatively conservative investor, I prefer to dollar cost average (DCA) into the market to slowly build up my portfolio. The advantages of using Interactive Brokers to buy the US shares via DCA are undoubtedly the low fees and ability to buy fractional shares of mega-cap technology shares like Alphabet and Tesla. In the near term, the fear of the FED raising interest rates non-stop to induce a recession dominates the headlines. The latest FED meeting in September showed that the FED may have no intention to pivot and lower interest rates anytime before 2024. Furthermore, Russia has threatened to continue with its full fledge invasion against Ukraine. This will have a negative impact on inflation numbers, especially as we are entering the winter months in European countries, which may propel gas and oil prices in the last quarter of the year. For September 2022, my dividend portfolio has suffered a decline, as the continuous rising bond yields made the risk-free rates much more attractive than REITs' dividend yields. This caused the REITs to plummet with no end in sight, but I just got to hang on and ignore the noises, and stay calm collecting dividends. In the same situation, my US Growth Portfolio has sunken deeper into the red. With all things beyond my control, I will just sit tight and hang on, and continue my brainless DCA into the market slowly and wait for recovery.

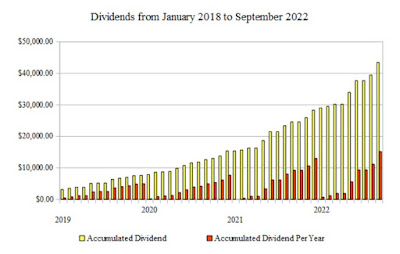

Despite the redness in portfolio value, dividends collected in the third quarter has been satisfactory, at SGD 5,789.21, boosted by semi-annual dividends from OCBC, Hong Leong Finance, Parkway Life REIT, Capitaland Integrated Commercial Trust, ST Engineering and Mapletree Family REITs. This brings the total dividends collected in the first 3 quarters of the year to SGD 15,158.60. This definitely allow me to conclude that I will be able to hit my annual target of SGD 16.5K (which is an increase of about 25% from previous year), and even go above it. Based on trailing twelve-month dividends collected per month, the average dividends collected monthly now is above SGD 1,570.00, which is another small milestone for me.

SG Dividends Portfolio

US Growth Portfolio

Total Portfolio Value = SGD 425,061.76 (USD 1 : SGD 1.4300)

Comments

Post a Comment