How Does SGD 200K Of Annual Dividends Sound To You?

In the recent video by The Fifth Person, they interviewed the famous local blogger (and budding YouTuber) AK, author of A Singaporean Stocks Investor (ASSI). In his blog and in this interview, AK revealed that his portfolio has compounded and delivered an annual dividends of SGD 200K in 2022! This is definitely eye-popping, a source of envy and admiration, and an inspirational figure whom I wish to follow.

That is a goal that I would can only wish to reach, but currently it is definitely far-fetched, especially when my annual dividends is just 10% of that amount, and I am already planning to Barista FIRE in 3 years time. Personally, aiming for 20% of that amount in annual dividends sounds more realistic and achievable to me. However reading his blog and 'listening' to what AK says to himself is an enjoyment. He has always preached his investing philosophy of 3P's, being prudent, patient and pragmatic. In addition, his advice for investors with the mnemonics of "Eat Crusty Bread With Ink Slowly" - which stands for Emergency Fund, Central Provident Fund (CPF), Borrowings, War Chest, Income, Sizing, is a great reminder for me to build a stable financial pyramid.

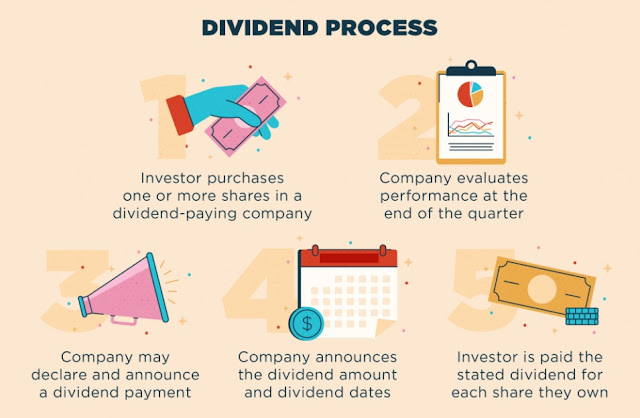

For a clearer sense of how this works, to generate an annual dividends of SGD 200K, a portfolio with dividend yield of 5% will require a humongous portfolio value of SGD 4M.

To achieve that, assuming an individual who starts working at 24, aiming to have that portfolio by 50 years old, will require the following:

1) Assuming portfolio grows by 10% annually including reinvested dividends, the individual has to invest SGD 30.1K per year (or SGD 2.5K per month) consistently for the next 27 years, or

2) Assuming portfolio grows by 10% annually including reinvested dividends, and the individual increase his investment capital by 5% every year until 40 years old, and maintain the same investment capital for the next 10 years, the individual has to start investing with SGD 20.45K in the first year, which increases to SGD 44.64K per year from 40 years old onwards, or

3) Assuming portfolio grows by 10% annually including reinvested dividends, and the individual increase his investment capital by 2.5% every year consistently for the next 27 years, the individual has to start investing with SGD 24.5K in the first year, which increases to about SGD 46.6K in the 27th year.

For myself, the above will no longer apply has I am already 15 years too late. I will have to compound with what I have thus far, and hope to achieve my personal goal in time to come. I will have a lot more to learn from AK, and I will be contented to be able to achieve a portfolio size which is a fraction (18%) of AK's. Coupled with retirement in Malaysia, I suppose the amount can be inflated when accounting for the exchange rate. I constantly have to remind myself to be less concerned with the fluctuations in share price because when I define/ categorize myself as a dividend investor, I should only be concerned with the income that the companies payout, with the prerequisite that the companies are financially and fundamentally sound. Snowball effect takes time. I just need to be patient. One step at a time, and gradually I can be where I want to be.

In the near term, I will have to boost my portfolio value to above SGD 500K. A small milestone achieved definitely provides more motivation in the journey. Next, I will have to hit my Basic Healthcare Sum (BHS) in my CPF MA within this year. My projection tells me that I will be successful in this, and the next step will be to grow my CPF Special Account. Reinvestment of dividends will continue, to keep my timeline towards Barista FIRE in check.

That's all for now! Just got to write this short post as a SGD 200K dividend income per year will be a fascinating dream come true (though far from my reality). However, I just need to be realistic to do my best and achieve what I can. Barista FIRE, here I come...!

Hi

ReplyDeleteGood & thoughtful plan there. Having multiple income streams (both passive & active) is ideal.

Having a sizeable or adequate income is a necessary but not sufficient condition. A good income stream must:

1. Be sizeable to be meaningful

2. Be stable and reliable. The income must not be dependent on market condition. Otherwise the income will be disrupted in a bad economy or market crash.

3. Sustainable. That is, it must be able to last your retirement duration.

We have built up six income streams or taps to fund our retirement. And we ranked them according to their stability and reliability.

Suffice to say (based on our experience) the dividend and rental income taps ranked the lowest in terms of stability and reliability.

We planned our retirement lifestyle based only on the most stable and reliable income sources. Incomes from our dividend and rentals are bonuses to us. We will use them to pamper ourselves (buy car, long travels and gifting) but we can do without them.

You can see how we built up our income taps here : https://t.me/CPF_Tree/1850

All the best.

HI mysecretinvestment

DeleteI do not know if my way of thinking works as I have not yet reached the retirement stage. But personally I would probably survive on income from dividends and maybe some part time work during semi-retirement/ recreational employment stage. CPF will be the stable bonus that I can choose to whether I want/ need to tap on it, or leave it in CPF to compound.

Nonetheless one thing for sure, it's great to have multiple sources of income.