Financial Stability to Financial Abundance- Perspectives From A Dividend Investor

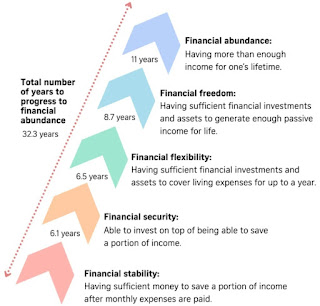

In June, an article in The Straits Times shook the finance blogger/ YouTuber sphere. In the article titled "Moving from financial stability to financial abundance takes Singaporeans 32.3 years: Study", it shares the report done by wealth manager St James's Place who did a study on 1,000 affluent Singaporeans aged between 24 to 64 with minimum annual household income from SGD 70K to above SGD 250K. In the report they concluded that it will take about 32.3 years for Singaporeans to progress from financial stability, financial security, financial flexibility, financial freedom and finally, financial abundance. After the release of this article, many financial bloggers and YouTubers like Kelvin Learns Investing and Josh Tan- TheAstuteParent posted their perspectives on this matter.

With respect to the study, I would like to highlight that the study is skewed to only include affluent Singaporeans and those with annual household income below SGD 70K are not included. Hence this may not really apply to the average (definitely not for me as my household income is less than SGD 70K), and from a biased standpoint, it takes 32.3 years probably because very few, or none of the sample size surveyed practiced Lean FIRE. Nonetheless, I believe how applicable the numbers are, depends very much on the individual. If one's expenses are low, then it definitely requires less than 32.3 years for personal financial abundance to be reached.

Before I begin, I would like to credit this post to financial YouTuber GenExDividendInvestor, who inspired me to write this post with one of his recent video on "7 Milestones In A Dividend Investor's Life".

As a dividend investor myself (hopefully I am one on the right track), my goal will be to build a portfolio that is able to generate annual dividends as passive income that is eventually able to cover my annual expenses. As such, instead of following the definitions of the 5 stages stated in The Straits Times, I will amend the definitions of the 5 stages to fit the context of a dividend investor.

Financial Stability: The stage where an individual has sufficient monthly income to cover all expenses, with 3 months of expenses saved up as emergency funds.

In this stage, individuals will have a basic, stable, healthy finances as the basic needs are met. Their monthly income can cover their expenses, with some excess that can be used to start building their dividend portfolio. Emergency funds are also well prepared to meet any sudden financial obligations/ shocks along the way. This marks the beginning of a budding dividend investor.

Using an individual who has a monthly expenses of SGD 2.9K (based on an individual like me aspiring to achieve Barista FIRE with the expenses stated in this earlier post) as an illustration, this meant having a dividend portfolio with a value of SGD 174K that generates an annual dividends of SGD 8.7K, or average monthly dividend of SGD 725. This sum, although not high, is able to cover basic needs like utilities, transport and part of food and groceries. If individual remains gainfully employed with a regular income, this dividend can be reinvested to compound and speed up the growth of the portfolio. This amount of dividend, coupled with the emergency fund, definitely makes an individual feel more financially secure.

Financial Flexibility: The stage where an individual has attained financial stability, and has build up a dividend portfolio that has a value of 12 times of annual expenses (based on a 5% dividend yield, the dividends can cover 60% of monthly expenses).

Using an individual who has a monthly expenses of SGD 2.9K as an illustration, this meant having a dividend portfolio with a value of about SGD 418K that generates an annual dividends of SGD 20.9K, or average monthly dividend of SGD 1.75K. This sum is able to cover most needs like utilities, transport, food and groceries, insurance and even taxes. Similarly, if individual remains gainfully employed with a regular income, this dividend can be reinvested to compound and propel the growth of the portfolio. This amount of dividend, coupled with the emergency fund, definitely makes an individual feel financially secure, with more flexibility in life for occasional indulgences, travel and even a possible impulsive career switch.

Financial Freedom: The stage where an individual has attained financial stability, and has build up a dividend portfolio that has a value of 20 times of annual expenses (based on a 5% dividend yield, the dividends can cover 100% of monthly expenses).

Using an individual who has a monthly expenses of SGD 2.9K as an illustration, this meant having a dividend portfolio with a value of SGD 696K that generates an annual dividends of SGD 34.8K, or average monthly dividend of SGD 2.9K. This sum is able to cover the entire monthly expenses. At this stage of financial freedom, this amount of dividend, coupled with the emergency fund, definitely makes the individual experience the massive options he or she has never really been granted before. The individual is now blessed with choices. The choice to remain employed/ working to stay active, or the choice to quit the rat race to enjoy the physical and mental relaxation, or the choice of hybrid arrangement to work part time with a lot more personal time for family and self. If ever the individual decides to continue working and decides to reinvest part or the entire sum of dividends, then the individual can propel towards the last stage of financial abundance.

Financial Abundance: The stage where an individual has attained financial stability, and has build up a dividend portfolio that has a value of 25 times of annual expenses (based on a 5% dividend yield, the dividends can cover 125% of monthly expenses).

Using an individual who has a monthly expenses of SGD 2.9K as an illustration, this meant having a dividend portfolio with a value of SGD 870K that generates an annual dividends of SGD 43.5K, or average monthly dividend of SGD 3.6K. This sum is more than sufficient to cover the entire monthly expenses, with excess that can be reinvested to safer instruments like long term bonds/ Singapore Savings Bonds (SSB) for further stability. At this stage of financial abundance, this amount of dividend, coupled with the emergency fund, will allow the individual to experience more options, be it for work or entertainment. The powerful part of financial abundance is that the principle amount (portfolio size) will never deplete as only the dividends are used. This enables the entire portfolio to be passed down as a form of legacy to future generations, securing your child's financial future as well. This stage is entirely optional, and largely depends on the individual.

It is imperative to note that the above illustration depends on individuals and the numbers fluctuates based on individual circumstances. More importantly, the above numbers only work if the individual does not succumb to lifestyle inflation when their earnings increases. I have to admit that the above is just an overly simplified illustration, and the numbers will vary when individual circumstances change at different stages of life, but it is nonetheless a good gauge to follow if a dividend investor aspires to achieve financial independence with their dividend portfolio. Do note that one should not be too fixated on the timeline to achieve these stages as well as individuals' needs and aspirations differ. You own your own timeline, you call the shots. The time is in your hands.

Personally as one who strives towards Barista FIRE, I think I am currently at the stage of financial flexibility. Definitely still some years away from financial freedom. Hopefully to reach there in 6 years or less. Barista FIRE, here I come...!

Hi BaristaFire

ReplyDeleteYou rightly pointed out that the Straits Times article was skewed towards the affluent in S'pore.

Not only that, the article deliberately avoided tagging a quantitative value to each wealth stage. Without quantitative values, it becomes very fuzzy for people to benchmark where they are.

In this respect I find that this old piece written by 15 Hour Work Week gave a better reference : https://www.my15hourworkweek.com/2021/04/13/the-six-steps-of-the-wealth-ladder/

And financial wellness (eg., fimancial stability, security etc) very much depends on the stability and reliability of your cashflow (both active and passive).

One cannot have financial stability nor security if your income (whether passive or active) is not reliable nor stable.

To have financial security and stability, one must have secure and reliable income source/s. The more sources the better. And to have financial freedom, one must have substantial secure income over and above your annual expenses. And your expenses must cater for future medical expenses when your health and mobility have deteriorated.

I have shared with Financial Horse and 15 Hour Work Week how my wife and I built up our passive income sources and how we ranked according to their stability and reliability. See my sharing below :

Hi FH,

The Covid pandemic was the latest reminder to us not to be fully dependent on the dividend and rental incomes. Thats why we have “relegated” the above two passive income sources to “bonus” taps.

For me at least, I see that the human asset (myself) is the best income generating asset. Unfortunately the reality is that the human asset will eventually become a liability one day (when we retire). Instead of generating income, it will only be spending money.

So I have been preparing for this eventuality for a long time. To borrow the term (income taps) from the late CW, we have been building up our income taps as below. We ranked our income taps according to their stability / dependability or reliability.

Gold taps for income sources that are most stable / dependable. Our two Gold Taps are the yearly interests from our OA&SA, and the payout from CPF Life.

Silver taps for the next most stable / dependable. They are our SRS savings and our Medisave Account (MA).

Bonus taps for those not so stable / dependable sources ie our dividend and rental income sources.

Below is how the income taps come into play (combined for couple) :

2023 (we are 62 currently)

Gold Tap 1 (OA & SA interest) : $68K pa

(2022 interest was $65K)

Silver Tap 1 (SRS drawdown) : $42.4K pa

(Drawdown over 10 years)

Bonus Tap 1 (Dividends) : $88K pa

(2022 dividend = $88K)

Bonus Tap 2 (rental) : $42K pa

(2022 rental = $39.2K)

2031 (70 yo)

Gold Tap 1 (OA & SA interest) : $68K pa

Gold Tap 2 (CPF Life payout) : $72.2K pa

Silver Tap 1 (SRS drawdown) : $42.4K pa

(Drawdown over 10 years)

Bonus Tap 1 (Dividends) : $88K pa

Bonus Tap 2 (rental) : $42K pa

The SRS tap will stop in 2032 after 10 years.

We planned our retirement lifestyle based only on our gold taps :

Gold tap 1 (OA & SA interest) : $68K pa

Gold tap 2 (CPF Life payout) : $72.2K pa (starts at 70)

The incomes from the Silver tap, the bonus taps (dividends & rental) are bonuses to us. We will use them to pamper ourselves, buy a car, go for long holidays, gifting, reinvesting, etc…but we can live without them. Also if our bonus taps perform well year after year, we may defer tapping on our Gold taps and let them compound further.

I am still working, so all the dividends and rentals collected are reinvested yearly to grow the dividends further. Interests earned in CPF stay in CPF to compound.

For details on how we built up our income taps, please visit : https://t.me/CPF_Tree

Hi mysecretinvestment!

DeleteThank you very much for the feedback. Yup it is always better to be more well-prepared then required to cater for any unexpected hiccups. I would say, for myself, my solid source of income during retirement will be my CPF Life. Technically, that will be the amount I will receive above what I needed for retirement from my dividends. If not used, it will be accumulated as cash buffers. Nonetheless, always have a plan that fits your personal lifestyle, timeline, needs and wants. Once that is all done, it's probably all good.