A More Detailed Plan For My Barista FIRE

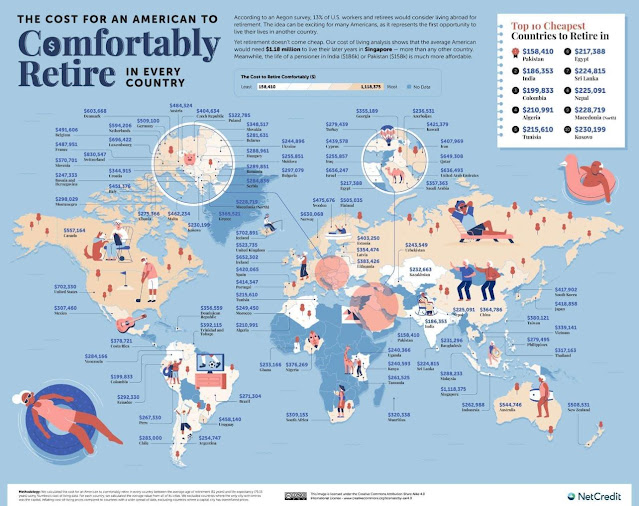

Sometime in March 2023, a study surfaced and it caused a little stir in social media. The picture below shows the cost for an American to comfortably retire in every country. Looking at the numbers, it's a little surprising that Singapore topped the charts, needing a shockingly high USD 1.12M (SGD 1.51M based on an exchange rate of approximate USD 1 : SGD 1.35) to retire comfortably, compared to other well-known expensive countries like Switzerland and United States, which only require USD 831K and USD 703K respectively.

As shocking as it seems, I think this chart only paints an accurate picture for the average American, and not for the general population. As a permanent residence in Singapore, I understand and experienced that Singapore has provided many subsidies and rebates for its citizens. Examples include subsidies in housing, medical, education, and rebates in conservancy charges, transport and utilities for eligible Singaporeans. All these definitely helped to defray the cost of living/ retiring in Singapore for Singaporeans, and to a smaller extent, permanent residents. Kelvin from Kelvin Learns Investing posted this video that gave a more accurate reflection of the retirement cost for a local in Singapore, which ranges from SGD 480K (single) to SGD 1.03M (family of four).

In addition, a friend of mine referred this video to me, which showed how a Singaporean couple retired in Penang, Malaysia. After watching it, I would like to highlight and quote what Ms Lena said in the video, "our assets in Singapore pays for our (retirement) life (in Malaysia)". This phrase resonated very much with me, as I stated something similar in my earlier post regarding retiring in Bangkok:

"However, I would like to highlight that all these is possible solely due to the strength of the Singapore Dollar. As an individual who earns the SGD, the expenses in Bangkok are all fairly affordable to me. However, if I compare the expenses to Malaysia Ringgit, I do not think it is any much cheaper. In fact, prices are either comparable to those in Johor, or even slightly more expensive in tourist regions."

All these being said, I will like to share my personal plan for Barista FIRE, and do a rough estimation if my projections can allow me a sustainable dream plan. In my previous post, I mentioned that my Barista FIRE number is SGD 24K a year, and FIRE number is SGD 36K a year. With inflation creating havoc, are these numbers going to be sufficient?

My dream plan goes like this:

Stay in Bangkok for a month sometime after Chinese New Year, depending on which day there's cheap tickets, and another month in Bangkok around August or September. The rest of the year, will be staying in my residence in Johor Bahru, with day travels to Singapore when required.

With regards to the expenses based on the above arrangement (current estimates):

The above are just conservative estimates of the monthly expenses, depending on how disciplined I am as a spender during the onset of Barista FIRE. As estimated above, it is largely in line with my Barista FIRE number of SGD 2k per month deriving from passive income. The additional required will be supplemented by part-time work/ more relaxed work at around SGD 1K to 1.2K per month. The above involved 2 assumptions. One, the outstanding mortgage loan of the Malaysia residence is fully cleared before Barista FIRE commences, and two, the Singapore property rental will be sufficient to cover the monthly instalments, property taxes and all other miscellaneous fees associated with the property. I hope that by the time I commence Barista FIRE, the mortgage rates in Singapore would have lowered to about 2% to 2.5%, so that the property can pay for itself. However, if things are not going smoothly as expected (for instance, inflation continues to create havoc, and all expenses are higher than estimated above, and cash top-ups are required to pay for mortgage instalments), I will need to work a little more and boost the income from part-time work/ more relaxed work to around SGD 2K to 2.2K per month. That should be more than sufficient for me to cover all expenses, and on top of that, save a little more for occasional holiday trips with family.

Once again, this blog post will serve as a personal reminder and reference on how I am going to budget when I am able to progress to Barista FIRE. Perhaps I can look back at this post on a yearly basis and recalculate if the numbers still make sense, and review all the changes required in the various categories, evaluate will I still be able to afford two 1-month trips to Bangkok per year, to ensure I am on track towards my goal. Always remember that situations are fluid, and circumstances changes along the way. Just remain flexible and deal with it when it comes, because the only constant, is change. For now, Barista FIRE, here I come...!

Comments

Post a Comment