What Can Malaysians (Singapore Permanent Residents) Living In Singapore Do To Deal With Inflation?

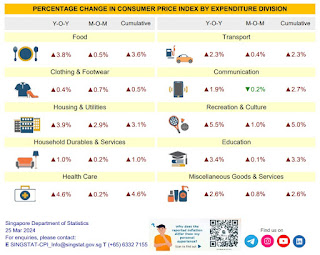

In the latest CPI report by Singapore Department of Statistics, core inflation rose by 3.6% year-on-year, and 0.5% month-on-month. For a more visually appealing statistics to see what affect individuals most, we can refer to the diagram below released by Singapore Department of Statistics:

For singles like me, I would like to think my expenses are relatively low, because I do not own a car, I do not take grabs or taxis in Singapore, only travel via bus, MRT and walking. My main expenses lies with dining, utilities, mortgage, household items replacement and healthcare. However, with the recent increase in GST, it is clearly making everything a tad more pricey. The price of many food items have risen by approximately 10-20%, and even bus and MRT fares, have risen by 10%. In a bid to deal with inflation, I checked with ChatGBT to find out how a Malaysian (SPR) like me staying in Singapore can find alternatives and ways to deal with inflation.

The following is what ChatBGT has answered me with:

1) Budgeting

2) Save and Invest

3) Meal Planning and Cooking at Home

4) Explore Hawker Centers and Local Markets

5) Comparison Shopping

6) Use Discount Apps and Loyalty Programs

7) Reduce Unnecessary Spending

8) Monitor Utility Usage

9) Review Subscriptions and Memberships

10) Explore Free or Low Cost Activities

11) Explore Government Assistance

12) Consider Housing Options

13) Utilize Public Transport

14) Monitor and Adjust

1) Budgeting: I am an old school tech-idiot, therefore I am recording my budget and expenses in an Excel spreadsheet instead of all the online expenses tracker available nowadays. So I would say that I am keeping track of my income and expenses, and running the numbers monthly. There are definitely ups and downs, and I know where the sum went to.

2) Save and Invest: I am currently in the midst of building up my SGX Dividend Portfolio and US Growth Portfolio. So far, it is doing ok I think, nothing spectacular, but I am happy with the year on year growth in dividends, which I am still reinvesting for further compounding. Looking forward to my "golden number" to be reached, so I may progress to Barista FIRE (but a buffer needs to be in place, so that it can better deal with inflationary macro-environment). Probably I need to tweak the numbers a little compared to what I stated in my previous post, by delaying Barista FIRE to 45, and FIRE by 48. All these are just estimates, and I can only wish I can meet the numbers!

3) Meal Planning and Cooking at Home: As I am working seven days a week this year, it is a little hard for me to cook at home. However as Wednesday is my pseudo rest day (as I only have one online lesson at home), I will prepare meals and dine at home once a week on Wednesday. In addition, I tend to buy in bulk from NTUC Fair Price, either housebrand or discount items, and charging the expenses on my HSBC Revolution card to earn 4 miles per dollar spent (no more, just been nerfed). However, it is actually cheaper for single diner to buy/pack ready-cooked meals from hawkers and coffee shops than to cook for one person at home.

4) Explore Hawker Centers and Local Markets: On all other days besides Wednesdays, I will be packing my food from coffee shops and hawkers. On certain days when I feel the need to reward myself, my favourite place will be Shabu Sai, a budget Japanese Hotpot buffet that is highly value for money. The SGD 22.80 (after service charge and GST) lunch buffet will keep me full for the whole day! This amount will be charged to my HSBC Revolution card to earn 4 miles per dollar spent. A little motivation once a while just keeps me going.

5) Comparison Shopping: I have minimal shopping habits and craze. When required, I buy my clothes online via Lazada and Shopee where the plus sized shirts, jeans and other items are at fraction of the cost compared to retail shops in Singapore and even Malaysia (comfortable plus-size clothes are hard to get). However it is important to remind myself not to be too caught up with online purchases and I have to keep to my budget as mentioned in (1). All spending here is also charged to my HSBC Revolution card to earn 4 miles per dollar spent.

6) Use Discount Apps and Loyalty Programs: I am guilty of this as I believe I did not make full use of this category, and the reason is because I am lazy to download so many apps into my phone. However, currently, I am making use to two reward system, one is "Healthy 365" and one is Malaysia's "AIA Vitality". The main reason I joined these two reward systems because they can motivate me to workout, every step counts. Through "Healthy 365", I can earn points to redeem NTUC Fairprice voucher to reduce my groceries expenses. Through "AIA Vitality", I can earn points and RM 5 weekly if I fulfil some criteria, which I can use to top-up my TNG wallet, subsidizing my expenses when I go to Johor Bahru.

7) Reduce Unnecessary Spending: This is very subjective, as what is view as unnecessary to one may be necessary to others. Just got to keep myself in check to avoid unnecessary spending. One way to help myself to verify if it is necessary or not, is to delay the purchase. If 5 days later, the product is still deemed necessary, then it probably is. Else, the amount can be saved.

8) Monitor Utility Usage: Staying in my own house, I have to manage household expenses as much as I could. The highest component of my household bill is the electricity bill, and the largest "wastage" I incurred is the air-conditioning that I kept on every night. My excuse will be getting a good night's sleep is very important, as it may negatively impact my work on the following day if I cannot rest well due to the heat. I shall continue to pamper myself with this, and work harder to cover the electricity bills. I pay my utilities using the POSB Everyday card, and the points earned and accumulated can be used as deduct against the future bill.

9) Review Subscriptions and Memberships: I have no subscriptions nor memberships. No unnecessary gym memberships as the only exercise I do is walking, ranging an average of about 10K steps a day. Neither do I subscribe to any Netflix or YouTube premium, I just watch free content online. So I would say, this amount saved can be contributed to my utilities.

10) Explore Free or Low Cost Activities: I have minimum activities as I work daily. Previously when I have off days for myself, I would return back to Johor Bahru during my off days to visit my mum. Nowadays, though I have no official off days, I will still video call my mum once a week. Besides that, my free time is usually spent at home chilling, since I am already paying mortgage for it. Make full use of the space and chillax.

11) Explore Government Assistance: Singaporeans get many rebates and assistance from the government, through CDC vouchers and CPF top-ups etc. For me, because of my status as a single Singapore Permanent Residence (SPR), I am not eligible for any form of government payouts. However, no complains on my end as it is largely my personal choice to remain as a SPR instead of converting to citizen, as I have plans to FIRE in Johor, and keeping a SPR status allows me to cross and clear both the Singapore and Malaysia immigration in a breeze via public transport (as long as there is no jams). However, one thing to be thankful for is that this year, income tax payable will be subjected to a 50% discount, and I am eligible for that. Though I am not earning much, but any discounts are definitely welcome!

12) Consider Housing Options: Once again, no choice for me on this regard because I am not eligible to buy HDB flats of any types as a single SPR, so I can only buy private property. I can only afford the cheapest of all, so I am currently living in a one bedroom apartment that cost below SGD 600K (I tried my best to find) and paying monthly mortgage on it. Currently my mortgage is still locked in at a low interest of 1.6%, but it is set to propel upwards by end of this year as the lock in period ends and I will have manage the substantial increase in my monthly mortgage. That is definitely going to inflate my expenses massively. Got to work harder to grind for my mortgage!

13) Utilize Public Transport: I am already doing my best now, and I believe I cannot improve further on this aspect. No grab, no taxis, only bus, MRT and walk, and I am using DBS Altitude Visa card for my public transport rides to earn miles from the fees paid.

14) Monitor and Adjust: This is one part I may be ignorant about, because I probably don't know what I don't know. If anyone has advice for me on how I can further reduce my expenses to combat inflation, do inform me as I would like to think that I have optimize my expenses and how I deal with inflation for now.

Overall, I believe one can only do so much in reducing expenses (or keep my expenses in check) to combat inflation. It will be better if one can build multiple streams of income so that the cashflow can cover all expenses and that will make inflation easier to deal with. For me, I am trying to increase my active income this year, and also continue to compound my dividend income. Shall continue to work towards my goal. Barista FIRE, here I come...!

Comments

Post a Comment