Portfolio Update for April 2024

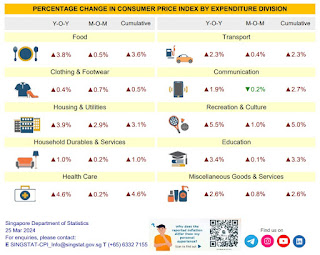

This will be a relatively short post, just to update on the transactions for the month. For the month of April, it is a gloomy month. The CPI for March is hotter than expected, and that is the third consecutive month where CPI was buck the desirable trend and went upwards. On the other hand, PPI was a tad more subdued, and PMI released recently showed signs of weakness in demand. One main worry was the intensification of the war in the Middle East, which was bad for inflation numbers due to the war's impact on the price of oil. In the wee hours of 13th April 2024, Iran began their retaliatory attacks on Israel through drones and missiles. Thankfully all drones and missiles were intercepted and no casualties are reported. Less than a week later, Israel also fired back in a limited retaliatory strike. Thankfully, it seems like both sides are halting further moves for now, and the tension seems to be defusing in the near term. I sincerely hope th...