2 Milestones Reached and A First-Time Income- BHS, 0.5M and SBL

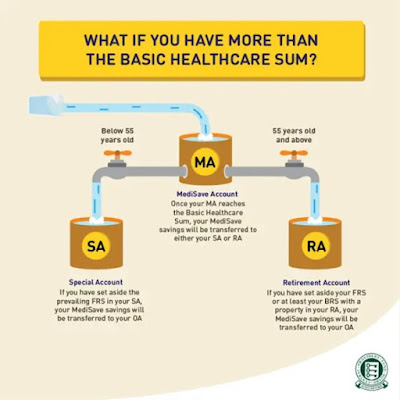

In this short post, I am updating on two milestones I finally hit, and a first time ever income received from an unexpected source. As above, the milestones are that I have achieved the Basic Healthcare Sum (BHS) in my Central Provident Fund Medisave Account (CPF- MA), which is SGD 68.5K in 2023, and for the first time, my portfolio value has exceeded half a million in value (as of 31st July 2023)! The first time income source is that I made some pennies from my Central Depository (CDP) from the Securities Borrowing and Lending (SBL) Program.

Achieving BHS

Earlier in April, I made the decision to speed up the contribution towards my CPF-MA by contributing to only my MA instead to all 3 accounts, aiming to hit the Basic Healthcare Sum (BHS) of SGD 68.5K in 2023. Just for context, I am self employed so I can have the choice to which account in CPF I can contribute my income to.

Hitting Half A Million Milestone (Which Diminished Soon After)

In addition, as stated in my earlier post in my monthly portfolio update for July 2023, my portfolio have finally exceeded half a million in value, boosted by Oversea-Chinese Banking Corporation, capital injection and dividend reinvestments for the REITs, Hong Leong Finance and Singapore Technologies Engineering. Not forgetting, the boost the portfolio gained from the US Growth Portfolio, where the rally in big Tech helped to push the portfolio into the green. However, I understand that volatility remains in the market and there is every possibility that the portfolio value may drop below SGD 500K again, and it actually did. After Fitch Credit Ratings decided to downgrade US debt from AAA to AA+, the markets had a red day, which brought the portfolio value down below the milestone. Nonetheless, I will ignore the volatility and continue with my reinvesting of dividends and dollar cost averaging into the portfolio, building it to more sustainable levels!

Pennies from SBL

In another event, back in 2018, I signed up for the SBL program via CDP. I signed up for it as I have the intention to accumulate shares to build up my dividend portfolio. To understand more about the SBL program and how to sign up for it, feel free to read up on this article by Seedly.

Long story short, I have actually forgotten about it, until recently I saw an amount deposited into my bank account. As the deposit reference is "Dividends or Cash Distribution", I did a search on what SBL fee means, which to my surprise, brings back memories that I had sign up for the program. So a quick check on my CDP account shows the following:

(Hmmm, so that means someone is shorting Frasers Logistics and Commercial Trust)

And my bank transaction showed this:

Although it is just SGD 1.16, it is free money (like additional dividends) from the shares I already owned, and that is definitely welcomed. However, SBL program is not popular in SGX because investors of the local market are mainly dividend investors who tends to accumulate shares for dividends, rather than trading or shorting shares for quick profits, therefore this extra 'dividend' is definitely once in a blue moon (this amount of income in 5 years from 2018 till 2023 is not even enough for a cup of kopi-peng in kopitiam). I suppose the US markets will have something similar and more profitable, but I don't think I have enough US shares to apply for such program.

Nonetheless, I shall continue towards my next near term goals of hitting annual dividends of SGD 24K, and work towards a more sustainable SGD 500K portfolio value. Barista FIRE, here I come...!

Comments

Post a Comment