A Review of How High Interest Rates Impact the Performances of the REITs I Hold

The REITs that I hold in my portfolio have all reported their latest earnings, therefore I think now it is a good time to review their performances to see the impact of the high interest rate environment on their respective earnings.

The summary of the net income, distributable income and distribution per unit are tabulated below:

From the numbers churned above, I believe the best performer is ParkwayLife REIT (PWLR), the top holding in my portfolio. All 3 metrics have improved year-on-year, although there are other metrics under some pressure like slight increase in cost of debt and slight decline in interest coverage ratio, but generally it is still healthy overall.

Capitaland Integration Commercial Trust (CICT) also showed resilient performance based on its improving net property income, and other improving metrics like improving occupancy rates and more importantly, positive rental revision rates. However, a clearer picture will be required to assess the performance as some metrics like distributable income and distribution per unit are not available. However, with the absence of any near term fund-raising or any dilutive actions, I believe this performance is positive and investors will be pleased with this set of results.

On the other hand, the performances of the Mapletree family REITs are a little disappointing. The best out of the 3 is Mapletree Logistics Trust (MLT). Although the gross revenue and net property income has decline slightly year-on-year, the positive average rental reversion is good for future earnings. In addition, the ability for the REIT to maintain their distribution per unit shows that the manager is prudent in managing expenses. This is definitely beneficial to shareholders.

However, I am a little concerned with the performance of Mapletree Pan-Asia Commercial Trust (MPACT) and Mapletree Industrial Trust (MIT). For MPACT, the numbers seemed superb but that is due to the differences in the incomes before and after the merger between Mapletree Commercial Trust and Mapletree North Asia Commercial Trust. Despite the increase in total number of issued units after the merger, the full year DPU managed to eke out a slight gain of 0.80%. However, how sustainable this is remains to be seen, because one of the main property under management, Festival Walk in Hong Kong has registered a huge negative rental reversion of -12.7%. Although this is an improvement from preceding two years, which registered negative rental reversions of more than -20%, it remains a form of downward pressure to both revenue and income for the MPACT. I will have to keep a close look to the performance of MPACT in the upcoming quarters, as China and Hong Kong open up post Covid. If the properties do not show any improvements in their performance in upcoming quarters, it may mean that the merger is not synergistic and probably it is time to divest.

Likewise, MIT has registered a decline in full year DPU despite increase in net property income and distributable income, due to a larger base of issued units from the dividend reinvestment plan (DRIP), and also higher borrowing cost. Another worrying aspect is the declining rental reversions in Hi-Tech Buildings, and the significantly lower rents that these Hi-Tech Buildings (which takes up 17.3% of the asset under management) command. That may create strains in upcoming revenue and net income for the REIT. Thus, these are definitely important aspects that I will continue to keep a close watch on in upcoming quarters as well.

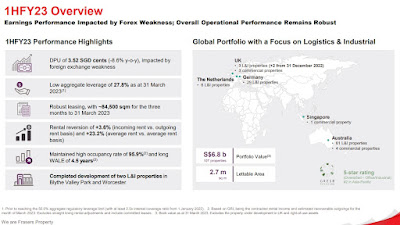

Based on the numbers, Frasers Logistics and Commercial Trust (FLCT) is definitely the worst performer. The huge percentage decline in net property income, distributable income and distribution per unit are definitely things that investors do not like to see. However, its share price did not decline like how MIT and MPACT's share prices did on the day they release its results. A deeper look into its earnings report will show that positive rental reversions, low gearing ratio and its low cost of borrowing remain as positive catalysts for its performance. The main problem the REIT faced is due to the unfavourable exchange rates, which caused the foreign earnings to be lower in SGD terms. The continued strength of the SGD against foreign currencies may remain a persistent issue that FLCT needs to deal with, which derives a significant percentage of its revenue from Australian and European properties.

Overall, it is undeniable that the high interest rate environment is creating stress to many REITs. However, some will perform better than others, depending on the financial strength of their sponsors, the type and quality of properties under management and the prudency of the managers. The performance of some REITs are more concerning than others, and I will continue to keep a close look at their earnings in the upcoming quarters. In the longer term, I believe part of the stress will be alleviated by late 2024 when any possibility of rate cuts happen. In the latest CPI report, CPI declined very slightly to 4.9% year-on-year. The decline, though very minimal, points to the desirable downward direction, and hopefully that is sufficient to make FED pause any rate hike actions in upcoming meetings. I am in agreement with what Jerome Powell said, that there will not be any rate cuts this year. I believe any possibility of rate cuts will only occur in 2024, but I do hope that there will not be any more rate hikes for the rest of this year.

At the meantime, probably I should consider reinvesting the dividends from the REITs into another stock, hence diversifying further and gradually decrease the allocation of REITs in my portfolio. On the flip side, it may also be a relative good time to continue to accumulate the shares of these REITs during these distressed times, in preparation for the upturn when rate cuts occur. So should I diversify or should I accumulate, I supposed it depends on which opportunity arises first. For now, Barista FIRE, here I come...!

Comments

Post a Comment