Are The Dividend Stocks and REITs In My Portfolio Performing Up To Expectations?

Recently I came across a post on InvestingNote sharing 7 Singapore-listed Companies That Pay Out Increasing Dividends Over The Last 5 Years. As a major follower and practitioner of dividend investing, I would love to do a similar comparison as a quick check of how the stocks and REITs in my portfolio are doing. Although dividends per unit (DPU) is not a sole consideration in the evaluation of the quality of the stocks and REITs, but it is one of the important metrics to look at, and it is definitely a much more dependable metric to consider compared to dividend yield. This is because DPU can only increase if the company or REIT is generating sufficient net income or profit to payout to shareholders (however, it is important to note that a payout ratio of more than 100% is a red flag), while dividend yield can increase solely because the share price is declining, which is not a healthy indicator of the stock or REIT. As such, I think it will be prudent for me to relook into the stocks and REITs in my portfolio to compare their DPU trends.

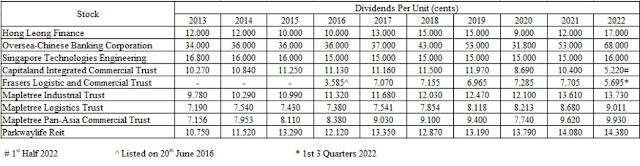

Above is the tabulated DPU of all the stocks and REITs in my portfolio for the past 10 years. For a better visual representation, the graphical trend is shown below:

Based on the data above, I am rather pleased with the stability in the performance of the stocks and REITs that I hold in my portfolio.

For the REITs, all of them showed a gradual increase in their DPU for the past 10 years (ignoring the sudden dip in 2020 due to the pandemic). Both Capitaland Integrated Commercial Trust (CICT) and Frasers Logistic and Commercial Trust (FLCT) showed a dip in DPU because they announce and pay their dividends semi-annually. As such, the dividends for the period September 2022 to March 2023 has yet to be announced and included in the calculation. Personally, for CICT, I am not too concerned about that as I believe after they release the earnings, its DPU will be propped up to resume the uptrend. However, for FLCT, its DPU may decline for 2022 because of the strength of the Singapore Dollar (which FLCT uses to report their earnings) versus the foreign currencies like Australian Dollar and Euro (which FLCT derives its earnings in). Nonetheless, I am not too worries as well as I believe in FLCT's historical performance, and when the interest rate decline in future, I hope managers of FLCT will carry out DPU accretive acquisitions to boost their portfolio. This can be easily done as currently FLCT has one of the lowest gearing ratio among all the Singapore REITs.

For the stocks, Oversea-Chinese Banking Corporation (OCBC) is definitely a great holding. Ignoring 2020, DPU is on the uptrend, and it has declared all-time high DPU for 2022. Hong Leong Finance (HLF) continued to remain stable. As I stated in my previous post, I have always treated HLF like a bond, as it's share price and DPU has remained relatively stable for the past 10 years, with the exception of 2020. The DPU for 2022 has returned to normalcy, and I am pleased with their payout. Singapore Technologies Engineering has also increased its DPU for 2022. Being in the defense business, I am happy with its stable DPU.

All in all, I think my portfolio remains resilient and I look forward to improving DPU in future (barring any further unforeseen black swan events). Working towards my Barista FIRE and FIRE numbers, slowly but surely! Barista FIRE, here I come...!

Comments

Post a Comment