With Rising Property Prices in Singapore, Will Freehold Condominiums Gain Popularity Soon?

In the past year or two, we keep hearing "frightening" stories of resale HDB flats, which are public housing in Singapore. They are called as such as they are constructed by the Housing and Development Board (HDB). These homes are affordable and can be easily purchased by the average Singaporean as they are subsidized by the government and are offered with housing grants. The flats all come with a 99-year lease. As clarified by the government, once the 99-year lease is up, the flat will have no value and is reverted to HDB, which will in turn surrender the land back to the State.

I use the word "frightening" because how one views the situation depends on which group the individual belongs to. If one is a owner/ seller, such news of million-dollar resale HDB flats is definitely great news to them, who is able to cash out from the sale, and use part of the proceeds to apply for another new build-to-order (BTO) flat, and the rest can be pocketed as profits (or returned to the CPF to repay the amount used to pay for the flat plus accrued interests). However, if one is a potential buyer, the escalating prices of properties in Singapore now is no less a horror story to them. Unless the buyer is a married couple, who is then eligible to apply for a new BTO (which is generally much cheaper than the resale properties due to the subsidies, but generally comes with a longer waiting time), else, ineligible parties or others who do not wish to wait will have to turn to the HDB resale market.

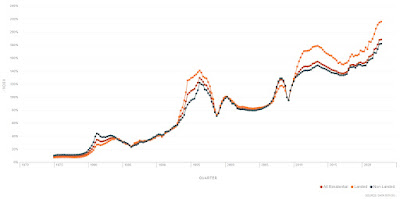

As seen above, the property index is reaching new highs again. In this post by Seedly, it basically concludes that BTOs are still affordable to the average Singaporeans, whereas HDBs in the resale market are still currently affordable, but may soon be out of reach. As an Asian, I was brought up in a traditional family, where my dad has made much planning for my brother and me. This got me thinking, will parents today be worried for their children in future, in case housing becomes a luxury due to runaway prices. And thus, this got me thinking, wondering will freehold properties ever come into the minds of parents today, as a means to prepare a home for their children (a practice widely done in China and Malaysia) while properties still seem affordable today.

Freehold properties, as the name suggests, has an unlimited tenure. Technically speaking, properties with freehold tenure in Singapore can be passed down from generations to generations as one will have full ownership of the property. However, in the event if the piece of land is required by the government, the government can buy it from you. In Singapore, only private condominiums and landed properties have freehold status. Freehold properties always command a premium over leasehold properties due to the unlimited tenure, thus it is not a popular choice of ownership/ investment in Singapore.

I know I seem to be comparing apples to oranges. HDB is public flats that are subsidized, while freehold properties in Singapore are private condominiums that are much more expensive than HDB. I understand that, but HDBs have no freehold status, and not all freehold condominiums are very expensive. There are some freehold condominiums that are boutique developments, with 2 bedroom units (or even 3 bedroom units in some development) costing less than a million currently. I know these properties are usually not popular with investors, but these 2 class of properties are currently most comparable in terms of price (which is compensated by the smaller unit size for the condominiums- that may be sufficient for families nowadays as family sizes become smaller generally with only one child), and to do the comparison with all properties being used for own-stay purposes and not for investment purposes.

Personally, I am single with no children, thus this is not a concern for me. I think this depends largely on individuals. I believe if a couple is able to, they will be willing to buy properties that can be handed down to their children. However, these cases are not common and are usually done by high net worth individuals, as the freehold properties bought in this scenario are usually freehold landed properties (which are kinda out of reach for the average Singaporeans). Based on my observation, the interests on freehold condominiums are generally lacking in Singapore, because of the many reasons given in this article, which I will not repeat here.

However, beyond those, I think there are 2 other reasons why freehold condominiums will not be of interest to the majority of Singaporeans if given a choice. Firstly, the time has not yet come for many HDBs in Singapore to hit the 99-year lease. Before that happens, some may hope to hit the Selective En Bloc Redevelopment Scheme (SERS) jackpot. When that chance applies to any resident, the resident will get the opportunity to move to a new home with a new 99-year lease, and also given a package comprising compensation and rehousing benefits. However, this is a rather rare chance as only a very small percentage of HDBs will have the opportunity to be selected under the SERS program.

The other main reason for this, is that I believe the Singapore government will continue to push out affordable BTOs at a faster rate to meet the increasing demands of Singaporeans. The government cannot afford to let all property types to experience runaway prices. The fate of the government still lies in the hands (votes) of the citizens (voters). I believe the government will still try their best to let at least the BTOs remain within reach of the average Singaporeans. As long as there is at least one option remain affordable, interest in freehold condominiums will always remain subdued amongst owners and investors.

However, all these are just personal opinions. I am no property expert, and just want to share my personal views on this matter. There are many factors, general and personal, that contributes to the choice of housing, like size, estate, amenities, proximities to school, etc. Overall, I still hope property prices in Singapore can continue to climb, but at a rate that can allow it to remain affordable to the majority. Cheers to everyone with a roof over their heads! I believe that's what matters. Barista FIRE, here I come...!

Comments

Post a Comment