Portfolio Update Q4 2022

This month marks the end of the 4th quarter of 2022. Thus being the last post of 2022, it's definitely a good time for me to record the performance of my portfolio to track how it has been.

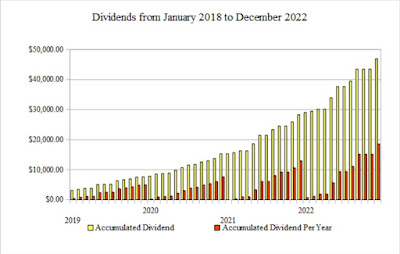

To recap, I started my SG Dividends Portfolio in late 2017, and I began tracking the dividends and all reinvestment done starting 2018. To date, my SG Dividends Portfolio consist of banks, REITs and defense technology. On the other hand, I only started the US Growth Portfolio in late December 2021. Currently, my US Growth Portfolio consist of mainly big tech names, bank and exchange traded funds (ETFs).

Being a relatively conservative investor, I prefer to dollar cost average (DCA) into the market to slowly build up my portfolio. The advantages of using Interactive Brokers to buy the US shares via DCA are undoubtedly the low fees and ability to buy fractional shares of mega-cap technology shares like Alphabet and Tesla. The latest FED meeting in December showed that the FED have no intention to pivot as yet despite inflation coming down to 7.1% (which is still at elevated levels compared to the target of 2%). This basically remains as a main pressure keeping in check the general market sentiments. For December 2022, my dividend portfolio remain largely on the downtrend, as the uncertainty of the peak rates looms, whose negative effects were softened slightly by the 10-year bond yields, which had declined from a high of above 4% to around 3.7%. This caused the REITs and the banks to remain volatile, and their price movements largely complements each other, keeping my portfolio stable to slightly negative.

In the same situation, my US Growth Portfolio has been rather volatile. The wild plummeting share price in Tesla is thankfully supported by others like JP Morgan, Apple and Microsoft (but all are dropping, just by a lesser extent compared to Tesla). With all things largely beyond my control, I will just sit tight and hang on, and continue my brainless DCA into the market slowly (while abiding to my purchasing rules) and wait for recovery.

Despite the redness in portfolio value, dividends collected in the fourth and last quarter has been below satisfactory levels, at only SGD 3,430.46 from quarterly dividends from Mapletree Family REITs, Fraser Logistics and Commercial Trust and ST Engineering. The positivity is that this brings the total dividends collected for the year 2022 to SGD 18,589.06. This is 12.7% above my annual target of SGD 16.5K, and most surprisingly, a shocking 43.0% increase from 2021's annual dividend. Based on trailing twelve-month dividends collected per month, the average dividends collected monthly now is around SGD 1,549.00.

For this month, the total portfolio market value dropped to approximately SGD 424k in this quarter despite a capital injection of SGD 2.7K, which is a decline of close to 3.4%! This also concludes my portfolio for the year of 2022, which, year to date, declined by approximately 18.1%. It's painful to look at and think about it, but nonetheless, life goes on. I believe it is still important to remain invested for me and look forward to higher total dividends next year! Barista FIRE, here I come...!

SG Dividends Portfolio

US Growth Portfolio

Total Portfolio Value: SGD 424,131.09 (USD 1 : SGD 1.3500)

Wow, it would be half a million portfolio if it's not due to market downturn. How far away from your golden number as Barista FIRE?

ReplyDeleteHi Kk, well, I still have some way to go... And the number depends on where I Barista FIRE... In Singapore, probably need a minimum of 3/4M before I can Barista... If I go to Malaysia, then probably 600K is ok (provided the yield don't drop significantly).

DeleteThought your aim is to semi retire at Malaysia, which is about 600k, which is about 100k+ short. It's very near to your dream of Barista Fire.

DeleteHopefully I can start Barista FIRE in 2 years... Provided the market be kind to me, lol

Delete