How Long is this Bear Market Going to Drag For?

By now, I am sad to announce that my portfolio is in the doldrums, not just red, but deep, dark red. I hope that not many are in similar situation as me, but I believe if you had continuously dollar-cost averaging into the market (be it US or SG market) in the past 2 years, there is a high chance your portfolio is not doing too well either. If we look at the S&P 500, the peak was at 29th December 2021, and by mid October 2022, S&P 500 has fallen by 25.24% in 289 days. Closer to home, the peak for STI was at 5th April 2022, and by mid October, STI has fallen by 11.76% in 192 days.

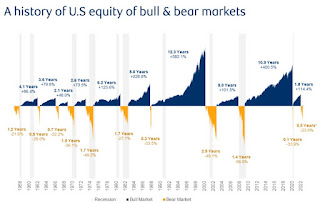

So, how long further is this bear market going to last? First and foremost, I definitely do not have any crystal ball (if I have any slightest foresight, my portfolio will not be in the state it is in now), so I am not able to give any prediction. However, if we take a look at history, that may give us a hint on how long further this bear is going to last, and possibly how much further the decline is going to be (do take note that this is just for sharing purposes, and it must be noted that past performances of the indices do not give any indication of their future performances).

In a tabulated form:

As seen above, the average duration of the bear market from top to bottom lasts about 342 days. The shortest lasted only 33 days during the height of the pandemic 2 years ago (due to the FED stepping in to stem the drop with their unlimited Quantitative Easing policy) while the longest lasted 546 days during the burst of the 'dot-com' bubble in year 2000. If the situation is optimistic, the market may turnaround in approximately another 2 months based on the average duration, while if the situation is biased towards pessimism, the market may continue to try find its bottom minimally in another 8.5 months or longer.

In terms of the extent of decline, the market plummeted by 33.4% on average. The S&P 500 dropped the least by 21.63%, and plunged the most by 51.93%. Similarly, if the situation is optimistic, the market may turnaround with another 8.2% drop on average, while if the situation is biased towards pessimism, the market may continue to try to find its bottom minimally by crashing another 26.7% from mid October levels.

In addition, the STI is lagging the S&P 500 by approximately 4 months. Does that mean that STI has a longer duration, and larger extent to fall compared to S&P 500? It may happen this way, it may not, but I believe that once the US market pivots and turn around from its bottom, STI will follow soon, as all along STI is rather passive and it follows the direction of the US market. However, a thing to note is quite a significant composition of STI belong to REITs. Besides the movement of the US market, we may also need to look at the interest rate level. If interest rate remains at elevated levels for longer period of time, that may delay the recovery of the REITs, and hence the STI.

So, which will it be? Optimism or pessimism? I have no idea. The bottom will only be known after we have passed it. The only thing we can do now is, as I have been saying all these while, hoping for the best case scenario, while be prepared for worst. As in my previous post, I will just continue to slowly dollar-cost averaging into the market. For US Growth Portfolio, I will continue to slowly buy bit by bit as long as the share price remains below my average holding price. For the SGX Dividend Portfolio, I will only buy when the REITs command a dividend yield above 6.5%, while for non-REITs, when they command a dividend yield above 5%.

As of 14th October, all US shares in my portfolio are below my average holding price, so I will slowly buy in the shares. As for SGX shares, Frasers Logistics and Commercial Trust, Hong Leong Finance and Singapore Technologies Engineering met the criteria for further purchase. I will continue to hold on to my portfolio, and at the same time, keep a close eye on the debt levels of the various companies and REITs as the interest rates continue to rise, which may eventually be the tipping point for the companies/ REITs if not kept in check. For now, stay calm and collect dividends. Barista FIRE, here I come...!

It'll last till the Fed pivots, or market feels that Fed is going to pivot :)

ReplyDeleteHence all will be glued to the inflation & jobs reports.

Hopefully so, and based on market sentiments, it's probably earliest next year. So meanwhile, continue to hand on for dear life, lol

Delete