Portfolio Update Q1 2022

This month marks the end of the 1st quarter of 2022. Thus it's definitely a good time for me to record the performance of my portfolio for the very first time to see how it has been.

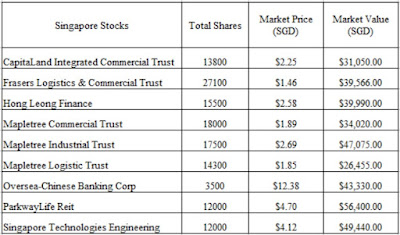

I started my SG Dividends Portfolio in late 2017, and I began tracking the dividends and all reinvestment done starting 2018. To date, my SG Dividends Portfolio consist of banks, REITs and defense technology. On the other hand, I only started the US Growth Portfolio in late December 2021. I took the opportunity to start the growth portfolio as the US market corrected, which made me believe it's a relatively safer time to enter the market compared to the all time highs in mid November 2021 for the NASDAQ. Currently, my US Growth Portfolio consist of mainly big tech names, bank and exchange traded funds (ETFs).

Being a relatively conservative investor, I prefer to dollar cost average (DCA) into the market to slowly build up my portfolio. The advantages of using Interactive Brokers to buy the US shares via DCA are undoubtedly the low fees and ability to buy fractional shares of mega-cap technology shares like Alphabet and Tesla. Despite the high volatility due to high inflation numbers, FED raising interest rates and the shocking Russia-Ukraine war, which caused the steeper correction in late February, I am pleased that by end of March 2022, both my dividend and growth portfolio are in the green. This is possible due to the relatively stable Singapore market (with good news regarding the opening of the borders), and the rebound in the US market in late March (with good news on possibly the end of Russia-Ukraine war).

Dividends collected in the first quarter has been low, at SGD 1,871.15. This is mainly because most of the companies and REITS I hold now release their earnings half-yearly now instead of quarterly. Thus the dividends collection will be lumpy. Nonetheless, if based on trailing twelve-month dividends collected per month, the average dividends collected monthly now is above SGD 1,000.00, which is a small milestone for me.

Another milestone achieved this month is the total portfolio market value has successfully crossed the SGD 400k in this quarter! Looking forward to the next milestone! Barista FIRE, here I come...!

SG Dividends Portfolio

US Growth Portfolio

Comments

Post a Comment